The 2025 Municipal Budget includes a 6.9% increase in dollar to dollar over the 2024 Budget, which resulted in a 5.69% increase in the municipal tax rate (municipal tax rate x residential assessment = municipal portion of taxes). Some of the 2025 increases are due to increased Insurance costs, Human Resources (additional positions), Policing contract increases, Equipment and Vehicle Maintenance costs, and Computer Hardware and Software expenses.

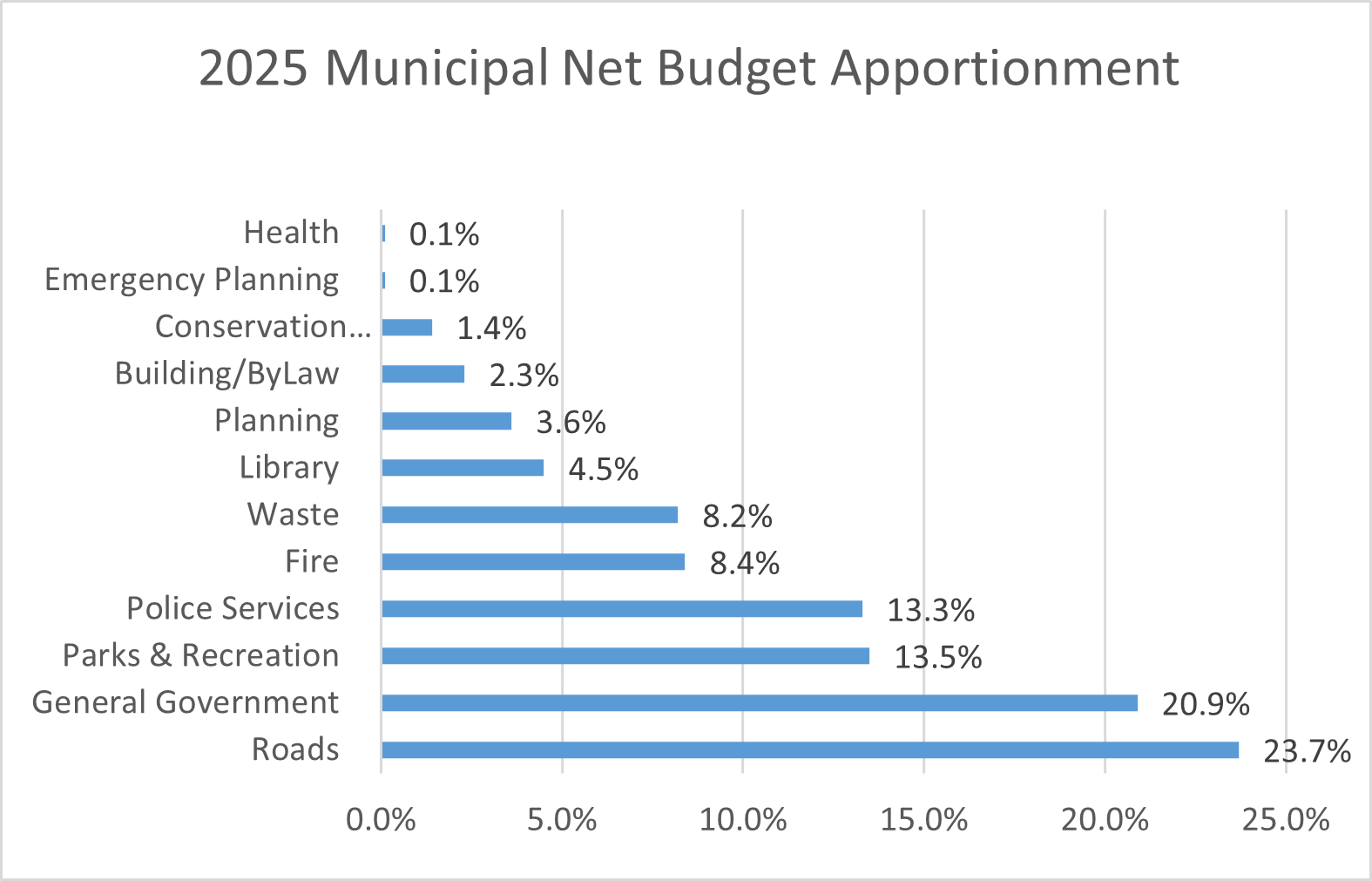

| Department | Percentage % |

|---|---|

| Building and By-Law | 2.3 |

| Conservation Authority | 1.4 |

| Emergency Planning | 0.1 |

| Fire | 8.4 |

| General Government | 20.9 |

| Health | 0.1 |

| Library | 4.5 |

| Parks & Recreation | 13.5 |

| Planning | 3.6 |

| Police Services | 13.3 |

| Roads | 23.7 |

| Waste | 8.2 |