FAQ's:

A: Mailing address changes must be signed and submitted in writing to the Finance Department by the registered property owner. We accept submissions through email, fax, in person or through the mail. Please refer to the Changes to Mailing Address tab to find the Change of Mailing Address Form and more information.

A: If you would like a property tax receipt or need to confirm the status of your property taxes, please contact the Finance Department through email or at (705) 656-4445 extension 905. At this time property owners are not able to check on the status of their property taxes through the website.

A: Tax bills are sent to all property owners. If you are on a Pre-Authorized Payment Plan, a copy of the tax bill will be sent to you for information purposes only. Please refer to our Payment Options tab for more information on Pre-Authorized Payment Plans.

A: There are several impacts to the property taxes for example, the change in assessment on your property and the budgets for the Township, County, and School Boards.

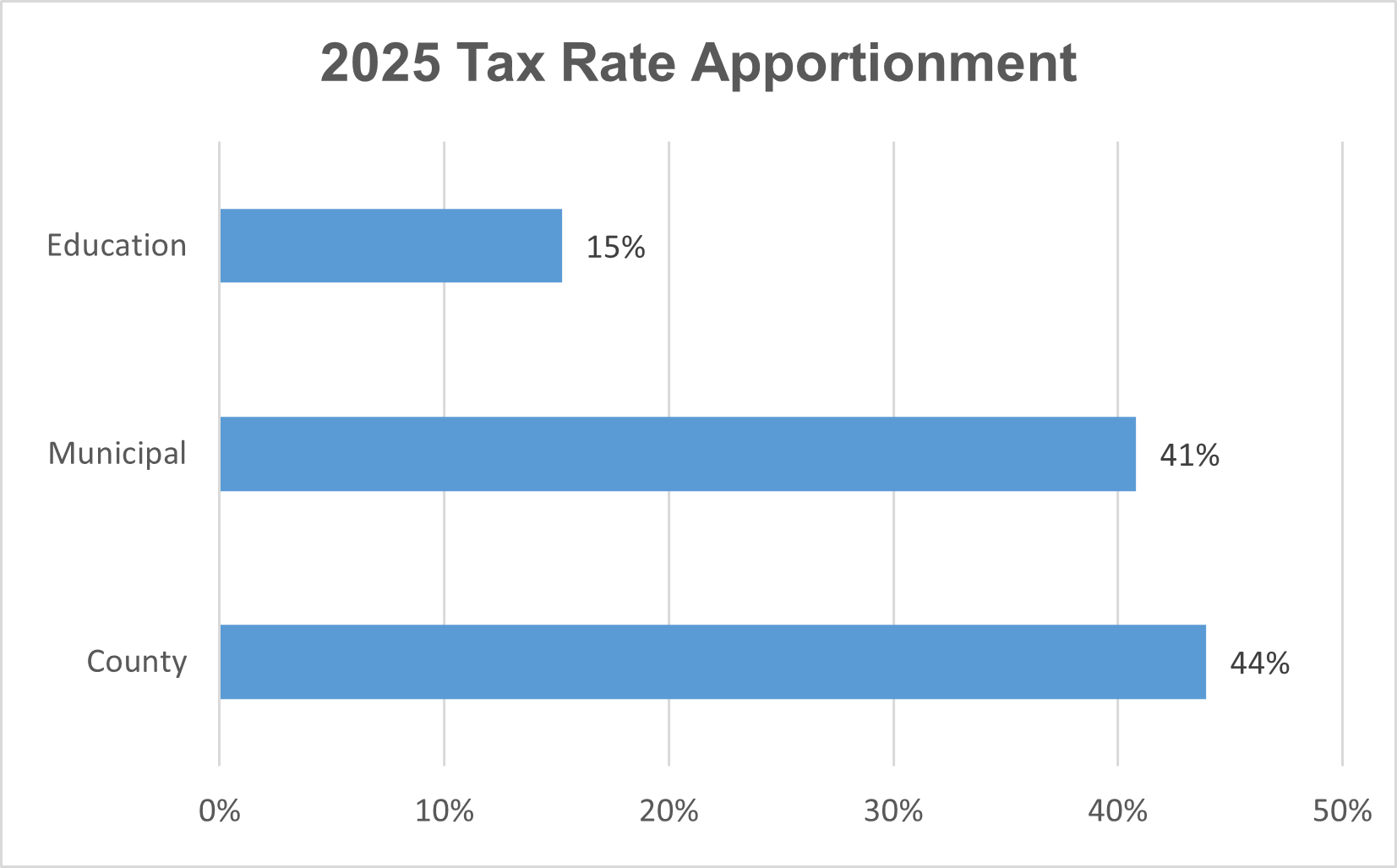

A: MPAC provides assessment values on each property to the Township. When the municipal budget is set, the tax rate is calculated. The County provides their tax rate to the municipality after their budget is passed, and the Education rate is set by the Province. The tax amount owing is calculated by multiplying the property's assessment value by these three tax rates. Please see the Tax Rates tab for more information.

A: Your property taxes pay for a variety of services at the Township, County and Educational levels. Services covered by your Township taxes include (but not limited to): roads, street lighting, fire services, and parks and facility maintenance. For more information regarding the allocation of your taxes please see the Municipal Budget and Tax Rates options located on the Township's website.

A: The Municipal Property Assessment Corporation (MPAC) is responsible for supplying the Township of North Kawartha with all assessment information including your designated school support. If you would like to change your designated school board, please contact MPAC at 1-866-296-6722

A: If you do not pay your tax bill by the due date, a monthly penalty of 1.25% will be added to the outstanding principal amount until the balance is paid in full.

If you continue to not pay your taxes your property may become eligible for tax sale, a process whereby the Township may sell your property and have it sold by public tender or public auction as a way to recover the outstanding taxes (this is a last resort).